Not known Incorrect Statements About Tulsa Bankruptcy Filing Assistance

Not known Incorrect Statements About Tulsa Bankruptcy Filing Assistance

Blog Article

Getting My Bankruptcy Attorney Tulsa To Work

Table of ContentsThe Greatest Guide To Chapter 7 Bankruptcy Attorney TulsaAffordable Bankruptcy Lawyer Tulsa Fundamentals ExplainedThe 7-Minute Rule for Bankruptcy Attorney Near Me TulsaThings about Best Bankruptcy Attorney TulsaUnknown Facts About Tulsa Bankruptcy Attorney

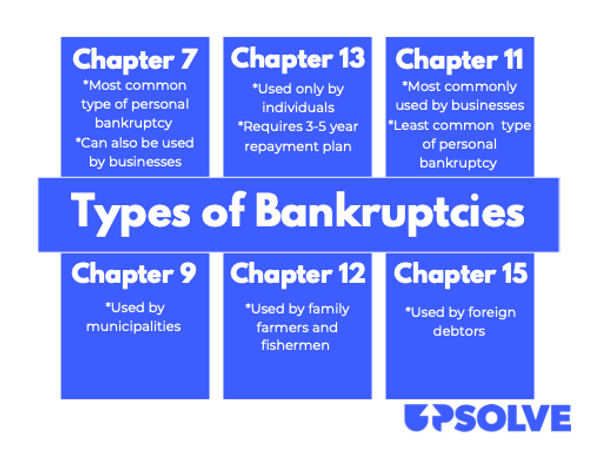

The stats for the other major type, Chapter 13, are also worse for pro se filers. (We damage down the differences in between the two key ins deepness below.) Suffice it to say, speak with a legal representative or more near you who's experienced with personal bankruptcy regulation. Right here are a few sources to locate them: It's easy to understand that you may be reluctant to pay for a lawyer when you're currently under substantial economic pressure.Many lawyers likewise offer complimentary consultations or email Q&A s. Make the most of that. (The non-profit app Upsolve can help you locate complimentary consultations, sources and lawful aid absolutely free.) Ask them if personal bankruptcy is indeed the best option for your scenario and whether they think you'll certify. Prior to you pay to file personal bankruptcy types and acne your credit score record for up to 10 years, examine to see if you have any viable choices like financial debt arrangement or non-profit credit scores therapy.

Ads by Cash. We might be made up if you click this advertisement. Advertisement Currently that you have actually chosen bankruptcy is certainly the best strategy and you hopefully cleared it with a lawyer you'll need to begin on the documentation. Before you dive into all the official bankruptcy types, you ought to obtain your very own papers in order.

Unknown Facts About Bankruptcy Attorney Near Me Tulsa

Later down the line, you'll in fact require to verify that by disclosing all sorts of details about your financial affairs. Below's a fundamental listing of what you'll need when traveling ahead: Determining records like your vehicle driver's certificate and Social Security card Tax obligation returns (up to the past four years) Proof of revenue (pay stubs, W-2s, self-employed profits, earnings from possessions as well as any earnings from government benefits) Financial institution statements and/or retirement account statements Evidence of value of your assets, such as car and genuine estate evaluation.

You'll desire to understand what kind of financial obligation you're trying to settle. Financial obligations like child assistance, spousal support and certain tax financial debts can not be discharged (and personal bankruptcy can not stop wage garnishment associated to those debts). Trainee car loan financial debt, on the various other hand, is not difficult to discharge, however note that it is hard to do so (bankruptcy attorney Tulsa).

You'll desire to understand what kind of financial obligation you're trying to settle. Financial obligations like child assistance, spousal support and certain tax financial debts can not be discharged (and personal bankruptcy can not stop wage garnishment associated to those debts). Trainee car loan financial debt, on the various other hand, is not difficult to discharge, however note that it is hard to do so (bankruptcy attorney Tulsa).If your revenue is too high, you have another option: Chapter 13. This option takes longer to solve your financial obligations because it needs a lasting settlement plan normally 3 to five years prior to a few of your continuing to be debts are wiped away. The declaring process is additionally a lot extra complicated than Chapter 7.

Top Tulsa Bankruptcy Lawyers Can Be Fun For Everyone

A Phase 7 personal bankruptcy remains on your credit rating record for ten years, whereas a Chapter 13 insolvency diminishes after 7. Both have long-term influence on your credit report, and any kind of new financial obligation you take out will likely include higher rates of interest. Prior to you send your insolvency types, you must initially complete a mandatory course from a debt therapy agency that has actually been accepted by the Department of Justice (with the remarkable exemption of filers in Alabama or North Carolina).

The training course can be completed online, personally or over the phone. Courses typically cost between $15 and $50. You have to complete the program within 180 days of declaring for insolvency (bankruptcy lawyer Tulsa). Use the Department of Justice's site to discover a program. If you stay in Alabama or North Carolina, you should choose and finish a training course from a list of individually approved service providers in your state.

How Chapter 7 Vs Chapter 13 Bankruptcy can Save You Time, Stress, and Money.

A lawyer will usually manage this for you. If you're submitting by yourself, understand that there are concerning 90 different insolvency districts. Examine that you're submitting with the proper one based upon where you live. If your irreversible residence has moved within 180 days of filling up, you must submit in the area where you lived the higher portion of that 180-day duration.

Commonly, your bankruptcy lawyer will collaborate with the trustee, but you might require to send the person papers such as pay stubs, tax obligation returns, and checking account and charge card statements straight. The trustee who was simply selected to your situation will certainly quickly establish a required conference with you, referred to click resources as the "341 meeting" due to the fact that it's a need of Area 341 of the U.S

You will need to supply a timely listing of what qualifies as an exception. Exemptions may relate to non-luxury, primary lorries; essential home products; and home equity (though these exemptions guidelines can vary extensively by state). Any type of residential property outside the list of exemptions is considered nonexempt, and if you do not give any list, after that all your residential property is considered nonexempt, i.e.

You will need to supply a timely listing of what qualifies as an exception. Exemptions may relate to non-luxury, primary lorries; essential home products; and home equity (though these exemptions guidelines can vary extensively by state). Any type of residential property outside the list of exemptions is considered nonexempt, and if you do not give any list, after that all your residential property is considered nonexempt, i.e.The trustee wouldn't market your sports car to quickly pay off the creditor. Instead, you would certainly pay your lenders that quantity throughout your payment plan. A common misunderstanding with insolvency is that once you submit, you can stop paying your debts. While insolvency can help you clean out most of your unsafe financial debts, such as past due clinical expenses or personal fundings, you'll intend to maintain paying your regular monthly settlements for safe financial obligations if you intend to maintain the building.

8 Simple Techniques For Bankruptcy Law Firm Tulsa Ok

If you go to threat of repossession and have actually worn down all various other financial-relief options, then applying for Phase 13 might postpone the foreclosure and conserve your home. Inevitably, you will still require the revenue to continue making future home loan payments, as well as paying off my link any late settlements over the training course of your layaway plan.

If so, you may be called for to offer added info. The audit might delay any debt relief by numerous weeks. Of program, if the audit turns up wrong details, your instance can be disregarded. All that claimed, these are rather rare instances. That you made it this much at the same time is a suitable indication at the very least several of your financial debts are qualified for discharge.

Report this page